Good morning. You can find the link to my IV/MM composite charts here:

Overall Market Note Today's setup exhibits relative similarity to yesterday's structure, which should be factored into expectations and risk management.

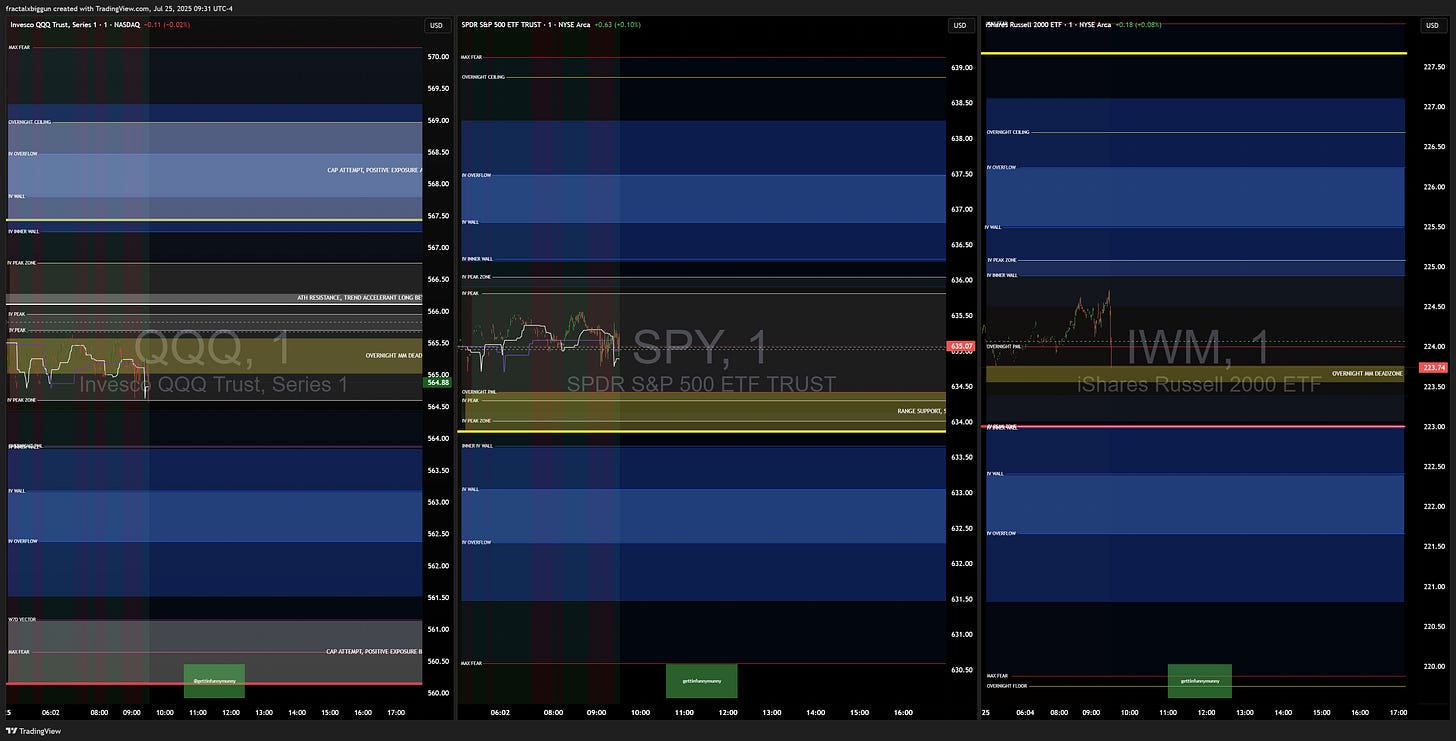

QQQ 0.00%↑

Overnight, we maintain a high-strength hedge prevalent regime. These conditions typically produce a high probability of a green close and high probability of failing to touch the 9:40 AM floor. Additionally, these conditions erode the probability of the 9:40 AM ceiling holding as session resistance while allowing for a weak chance to close above it, as high-strength hedge prevalent regimes demonstrate higher affinity for positive exposure.

Overnight, we are encountering resistance at our pivot level. If we maintain the pivot level/ATH resistance as session resistance, the developing trend will grow short over time, heading toward the overnight PML, inner IV wall, and true IV wall zone. Should the pivot level and ATH resistances break and flip into support, we can continue long to our weekly ceiling and aggregated cap zone—a combination of the weekly ceiling, overnight ceiling, and true IV wall resistance. We anticipate a high-probability cap within this zone, with limited instances of positive exposure toward and beyond the max fear target level.

SPY 0.00%↑

Overnight, we maintain a high-strength hedge prevalent regime with high probability of a green close. We are attempting to test the pivot zone long on SPY overnight. If we can successfully maintain the pivot and aggregate range support, SPY will trickle long over time toward the 636 peak zone edge and potentially into the IV wall zone.

SPY remains in a technical environment of positive exposure ignition, meaning the inability for price to break weekly ceiling support requires MMs to aggressively buy delta over time to hedge, creating a positive feedback loop cascade that surges price toward and beyond our IV wall resistance. If range support is maintained at or below the low of day, we have high affinity to develop a long move over time toward the IV wall zone target level.

However, if the SPY range support can successfully be broken, we have conditions to develop a high-velocity short move as MMs are required to aggressively sell back delta to hedge their warehouse if the weekly ceiling support is lost. We must determine whether SPY can lose its pivotal supports and fall into alignment with the budding QQQ trend.

SPY demonstrates heightened potential for intraday positive exposure, which could see price gravitate to the overnight ceiling/max fear in outlier circumstances.

IWM 0.00%↑

Overnight, we maintain a weakening hedge prevalent regime. IWM is developing a long move off its option-implied pivot, heading toward the IV wall zone and potentially the overnight ceiling. We maintain a high degree of support at the overnight MM deadzone/overnight PML/peak center aggregate pivot. Should support be lost, we have one final secondary supportive test at the IV inner wall before a quick descent to the IV wall zone at 222.

If we maintain the pivot as support, we look to cap the range at the upside 226 IV wall zone, or secondarily at the overnight/weekly ceiling/max fear levels if positive exposure is ignited.

Stay Connected

For real-time updates on today’s intra-session OMM regime quantification and to access Russell and Milk's daily market analysis that complements this research, join our complimentary professional community lounge.

If you found value in today's market gameplan and want priority access to future insights, consider supporting our Substack publication.